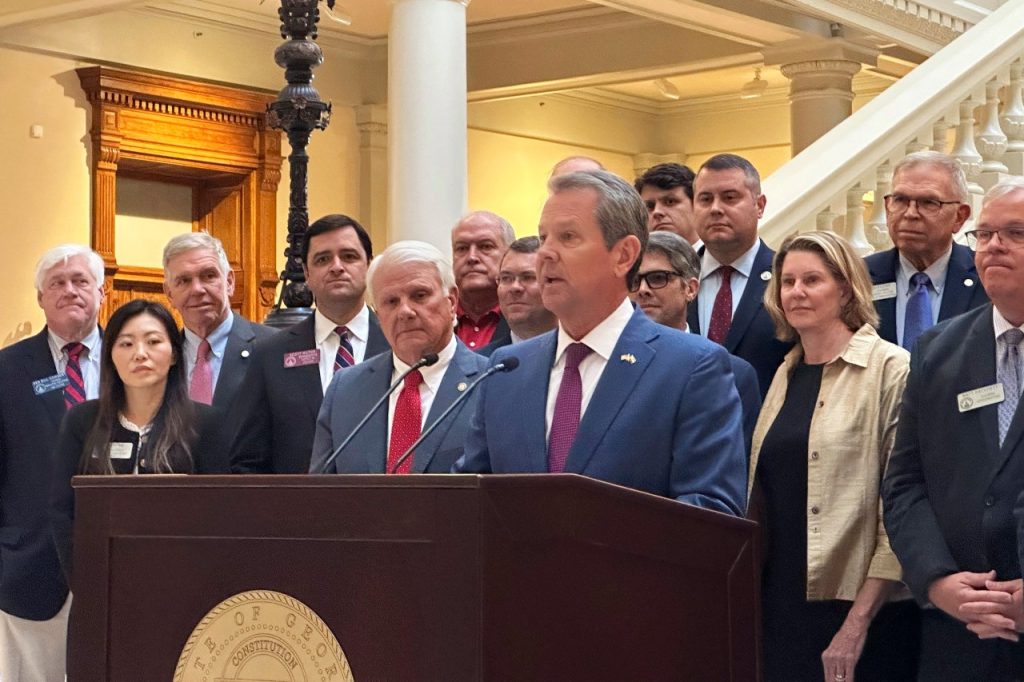

ATLANTA (AP) — Georgia Gov. Brian Kemp and Republican legislative leaders want to issue another round of income tax rebates, thanks to state financial reserves that continue to rise.

The leaders announced a proposal Tuesday to give refunds of up to $250 to single filers, up to $375 to single adults who head a household with dependents and refunds of up to $500 to married couples filing jointly.

Georgia issued similar rebates in 2022 as Kemp ran for reelection, and again in 2023. The rebates cost about $1.1 billion then. Legislators must approve the plan next year, but passage is likely as Republicans are expected to maintain their majorities in the General Assembly.

The announcement comes as Georgians continue to vote ahead of Nov. 5’s Election Day, and could be campaign fodder for a handful of Republican incumbents and challengers who are trying to win contested state House seats. It also allowed Kemp to sound themes about inflation that align with Republican Donald Trump’s campaign for president, which is trying to return Georgia’s 16 electoral votes to the GOP column after Democrat Joe Biden narrowly won the state in 2020.

“We all know that even if inflation has fallen, high prices haven’t,” Kemp said in prepared remarks. “Families see that every day when they go to the grocery store or the gas pump.”

The governor also said the measure, like his decision to suspend the state tax on gasoline and diesel fuel, was something he could do to help people in the eastern half of the state who were harmed by Hurricane Helene. Kemp said he and legislative leaders would discuss further hurricane relief efforts, as state leaders unite to push for quick payments, particularly to farmers who may have lost cotton, pecan or other crops.

In 2022 and 2023, the refund was automatically credited or issued to anyone who filed a state income tax return. That refund did not count as taxable income for state purposes but was taxable for federal income taxes. A taxpayer would only be able to get back a rebate up to the amount they paid in state income taxes. Some people with lower incomes pay little to no state income tax.

“Now what does this translate to for Georgia families?” Kemp asked. “That rebate means help paying the rent, or a car payment. It means school clothes for their kids or a shopping cart full of groceries. It means paying down the credit card debt, which people are living off of thanks to bad national policies.”

Democrats argue Kemp’s concern for working Georgians is fake and that he has skimped on essential services.

“The only thing that matters to Brian Kemp is improving his own political future,” Nicholas Savas, executive director of the Georgia Senate Democratic Caucus, said in a statement. “Instead of investing in our state’s future be expanding Medicaid, fully funding our schools, or lowering mortgage and rent costs, he’s trying to buy votes for Donald Trump with a one-time tax rebate.”

Although Kemp had long said that his tax relief efforts are meant to help fight inflation, economists say tax cuts, by putting more money into circulation, actually put upward pressure on prices.

Kemp has continually underestimated the amount of tax revenues that Georgia would collect in recent years, leaving the state with bulging bank accounts. State government now has more than $11 billion in unallocated surplus cash that leaders can spend however they want after Georgia ran a fourth year of surpluses.

The state has other reserves, as well, including a rainy day fund filled to the legal limit of $5.5 billion and a lottery reserve fund that now tops $2.4 billion. All told, Georgia had $19.1 billion in cash reserves on June 30.

The state has been spending its extra cash in other ways as well, using the money to pay for construction projects that Georgia would normally borrow to finance, shoring up a state pension funds, and speeding up already-planned roadwork.

In his reelection year, Kemp sought to put cash in the hands of as many voters as possible as he won a rematch against Democrat Stacey Abrams. He also cut gas taxes, increased state employee pay, and also made $350 payments to more than 3 million residents who benefited from Medicaid, subsidized child health insurance, food stamps or cash welfare assistance.