Buyers across the globe this week despatched President Trump a transparent message about his new tariff coverage, introduced triumphantly as a remaking of the financial order.

They don’t prefer it.

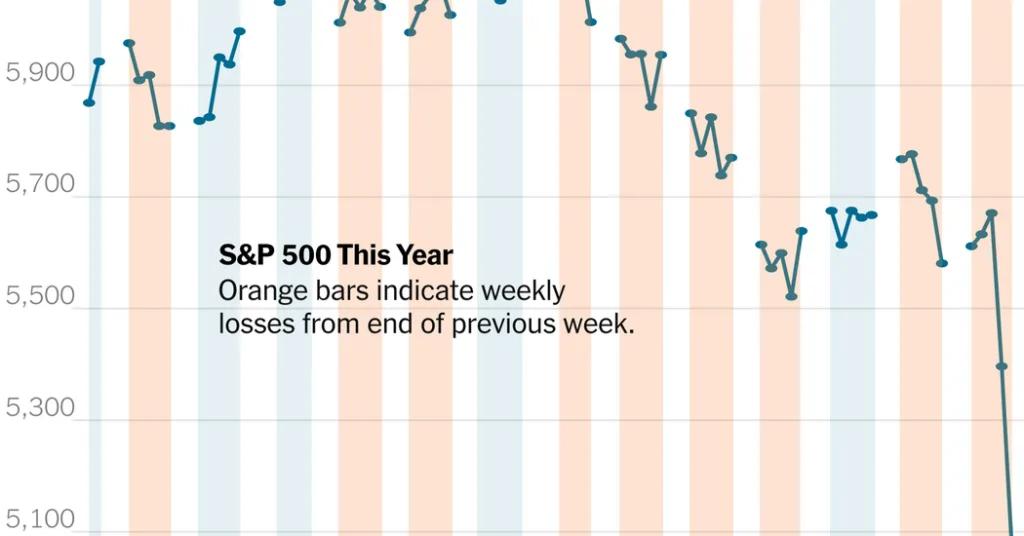

The S&P 500 fell 6 p.c on Friday, bringing its losses for the week to 9.1 p.c. Shares hadn’t fallen this far this quick for the reason that early days of the coronavirus pandemic — it was the steepest weekly decline since March 2020.

As then, the S&P 500 is shortly approaching bear market territory, a drop of 20 p.c from the most recent excessive that marks excessive pessimism amongst traders. By Friday, the index was down greater than 17 p.c from its February peak. The tech-heavy Nasdaq Composite and the Russell 2000 index of smaller firms, that are extra delicate to adjustments within the financial outlook, have each already fallen right into a bear market. World wide, shares have tumbled.

However this meltdown wasn’t pushed by the emergence of a brand new and lethal virus, or an unexpected housing disaster just like the one which worn out inventory values in 2007 and 2008 because it triggered the worst financial disaster for the reason that Nice Melancholy.

It was pushed by a coverage choice by the president.

“I hope that the message that the inventory market is sending to the administration is being heard,” Ed Yardeni, a veteran market analyst, mentioned in a tv interview. “The market is giving an enormous thumbs right down to this tariff coverage.”

Analysts and market historians struggled to level to a different time a president had straight inflicted a lot injury on the monetary markets. There are some current parallels: An ill-timed finances proposal by Liz Truss, Britain’s prime minister in 2022, led to days of market chaos, and she or he needed to resign inside weeks.

However Mr. Trump has proven no real interest in backing down. “MY POLICIES WILL NEVER CHANGE,” he wrote in a social media publish on Friday.

So traders, economists and enterprise leaders are unexpectedly assessing the brand new and unprecedented insurance policies and the financial injury that these insurance policies might trigger.

“We’re simply working via what this might presumably imply,” mentioned Lindsay Rosner, head of multisector fixed-income investing at Goldman Sachs Asset Administration. She added that the sheer scale of the tariffs “will increase the chance of a recession.”

It’s a exceptional flip in sentiment. After Mr. Trump was elected, and within the first month of his administration, traders have been desperate to see what a pro-business administration that had inherited a wholesome financial system may yield. Additionally they anticipated that the president’s impulses for radical financial change may be contained by the inventory market itself — a sudden drop may persuade him to alter course.

Regardless of considerations that shares have been extremely valued, they continued to climb — peaking in February.

However even earlier than this week’s meltdown, knowledge from EPFR World confirmed that traders had pulled $25 billion out of funds that put money into U.S. shares within the two weeks via Wednesday, when Mr. Trump introduced the tariffs. Since then, J.P. Morgan has raised its odds of a recession over the following 12 months to 60 p.c, Deutsche Financial institution slashed its forecast for the American financial system this yr, and others throughout Wall Avenue have lowered development expectations and raised inflation forecasts.

Buyers have additionally sharply raised the percentages of extra rate of interest cuts this yr, foreseeing a necessity by the Federal Reserve to step in to prop up the financial system. The promoting on Wall Avenue erased $5 trillion in market worth from firms within the S&P 500 in simply two days, in accordance with Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

As unhealthy because the current drop within the S&P 500 was, different market measures are in worse form. The Russell 2000 has misplaced 1 / 4 of its worth since its November peak. The Nasdaq Composite, which is loaded with tech shares that have been hammered this week, is down almost 23 p.c from its December peak.

“It’s saying that is actually unhealthy,” mentioned Liz Ann Sonders, chief funding strategist at Charles Schwab. “This exceeds something I noticed on anyone’s worst-case situation. This did extra to dent animal spirits, which had been one thing that had revived within the speedy aftermath of the election.”

Dan Ivascyn, chief funding officer of the big asset supervisor PIMCO, mentioned the tariff announcement this week represented “a large materials change to the worldwide buying and selling system” and would result in “a fabric shock to the worldwide financial system.”

“In current a long time, economics has tended to drive political choices,” he mentioned. “We could also be coming into a interval the place politics drives economics. That’s a really totally different setting to put money into.”

Some mentioned Mr. Trump himself supplied a precedent. In 2018, he imposed tariffs on world metal and aluminum imports, photo voltaic panels, washing machines, and $200 billion of products from China. However these levies pale compared with what was rolled out on Wednesday, and the impact on markets was much more muted.

Although Mr. Trump had all the time promised to make use of tariffs once more in an effort to restructure the American financial system — bringing manufacturing again throughout the nation’s borders and making the USA much less depending on overseas commerce — the size of the coverage shift caught traders, economists and enterprise leaders off guard.

The brand new taxes raised the common efficient tariff charge on U.S. imports to a stage not seen for the reason that Thirties, analysts at S&P, the scores company, mentioned.

Some traders maintain out hope that the tariffs are simply a place to begin for negotiations that may deliver them down over time.

However whereas Mr. Trump has urged that he’s open to negotiating tariffs with different nations, China has already reacted by matching his further 34 p.c tariffs. Canada swiftly launched tariffs of its personal, and Europe can also be anticipated to reply.

“The bottom line is so excessive proper now that even well-negotiated tariffs are going to be excessive,” mentioned Adam Hetts, world head of multi-asset at Janus Henderson Buyers. He feared that the injury had already been carried out.

“The injury is finished as a result of tariffs now have tooth, and client and firm habits is already beginning to change,” Mr. Hetts mentioned, echoing a concern held by different traders, too — that the tariff discuss has already chilled enterprise and client exercise.

Few chief executives have spoken out concerning the tariffs, however those that did expressed alarm.

Because the tariffs have been introduced, Gary Friedman, the chief govt of the furnishings retailer RH, was on an earnings name with traders. He was heard cursing, after checking RH’s share worth. RH will get a lot of its merchandise from Asia, Mr. Friedman defined.

On Thursday, Sean Connolly, the chief govt of Conagra Manufacturers, instructed analysts that the meals firm was making an attempt to maintain up with the sudden shifts in tariff coverage.

“Issues are transferring round not solely on a weekly or every day foundation however on an hourly foundation proper now,” he mentioned.

From the White Home, nonetheless, the message is one among exuberance — if traders simply have the persistence to see it via.

“The markets are going to growth,” and “the nation goes to growth,” Mr. Trump mentioned on Thursday. Howard Lutnick, the secretary of commerce, mentioned throughout an interview on Thursday that “American markets are going to do extraordinarily, extraordinarily nicely” over the long term.

Historical past exhibits that even the worst market disaster will come to an finish, as soon as traders are glad that costs have fallen far sufficient to mirror the brand new actuality, or one other shift in coverage offers them purpose to start out shopping for once more. On Friday, a report on hiring in March that was far stronger than anticipated, displaying that the financial system was nonetheless on a stable footing final month, didn’t stoke a market restoration.

Enterprise leaders have responded to surveys saying they intend to sluggish plans for their very own investments. Executives at airways, banks, retailers, power firms and extra watched their firms’ valuations drop this week. Customers, after making an attempt to get forward of the tariffs on some big-ticket objects, have mentioned they intend to spend much less, too.

“I’m undecided what we bought offers firms a number of confidence,” Ms. Sonders of Charles Schwab mentioned. “I feel it doesn’t alleviate that part of uncertainty.”