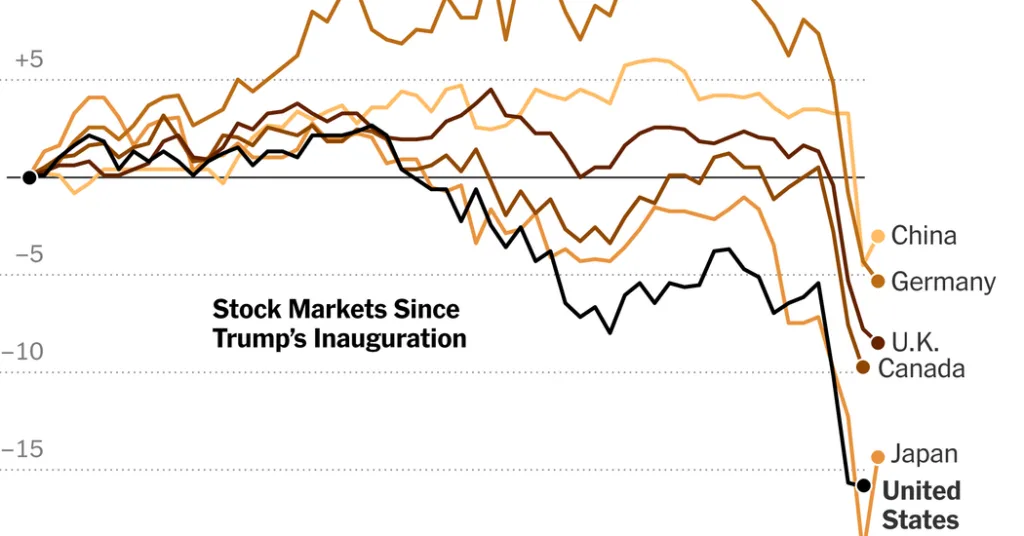

After three days of worldwide market turmoil not seen because the early days of the Covid-19 pandemic, shares regained a measure of calm on Tuesday regardless of little let up within the escalating commerce tensions attributable to President Trump’s tariffs.

Earlier than markets opened in China, the federal government unleashed a collection of measures to stabilize shares. In flip, share costs in Hong Kong, a day after plunging 13.2 %, and in mainland China jumped about 1.5 %.

Shares in Japan gained 6 %, recouping a portion of the earlier days losses. The rise in sentiment adopted feedback made on Monday by Treasury Secretary Scott Bessent, who mentioned he would quickly start discussions with the Japanese authorities concerning tariffs.

The Stoxx Europe 600 gained greater than 1 % in early buying and selling, with practically each main market within the area within the inexperienced. The pan-European benchmark stays about 15 % decrease than its peak in early March.

Markets world wide had been unmoored final week by Mr. Trump’s announcement of broad new tariffs — a base tax of 10 % on American imports, plus considerably increased charges on dozens of different nations. Nations have responded with tariffs of their very own on U.S. items, or with threats of retaliation. China retaliated forcefully on Friday, matching a brand new 34 % tariff with one in all its personal on many American imports.

In the US on Monday, the S&P 500 fell 0.2 % after tumultuous buying and selling that at one level pulled the benchmark into bear market territory, or a drop of 20 % or extra from its current excessive. S&P futures, indicating how markets may carry out after they reopen for buying and selling on Wednesday in New York, had been 1.5 % increased.

Wall Road executives and analysts are rising more and more apprehensive that escalating commerce tensions might do lasting injury to the worldwide economic system.

“The faster this subject is resolved, the higher as a result of among the destructive results enhance cumulatively over time and could be exhausting to reverse,” Jamie Dimon, the chief government of JPMorgan Chase, wrote in his annual letter to shareholders on Monday. Some financial institution economists are already forecasting that the economic system will slip into recession later this yr.

The ten.5 % drop within the S&P 500 on Thursday and Friday was the worst two-day decline for the index because the onset of the coronavirus pandemic in 2020.

With the brand new higher-rate tariffs set to enter impact on Wednesday, Mr. Trump has remained unrelenting on his commerce stance. On Monday he issued a brand new ultimatum to China to rescind its retaliatory tariffs on the US, or face extra tariffs of fifty % starting Wednesday.

However China confirmed on Tuesday that it’s not relenting.

A number of authorities departments and government-owned enterprises pledged to “keep the graceful operation of the capital market.” And the Individuals’s Financial institution of China, the nation’s central financial institution, vowed to assist Central Huijin Funding, the arm of China’s sovereign wealth fund that mentioned it was rising its holdings of inventory funds.

As well as, dozens of firms, a lot of which had been owned by the federal government, introduced that they had been shopping for again a few of their shares, a transfer that usually lifts inventory costs.

The strikes by what is called China’s “nationwide group” had been paying homage to efforts Beijing took throughout a market disaster in 2015.

On the time, the Chinese language authorities’s efforts to shore up inventory costs got here after its personal misjudged steps to spice up after which cool costs. This time, Beijing’s intervention seems to chime with a method by the Chinese language chief, Xi Jinping, of presenting his authorities as a pillar of regular calm in opposition to the worldwide financial turbulence unleashed by Mr. Trump’s tariffs.

It stays to be seen how efficient Beijing’s actions can be. The meltdown in Chinese language markets a decade in the past was pushed by a sudden lack of confidence by traders, so propping up shares helped calm nerves, mentioned Zhiwu Chen, a professor of finance at The College of Hong Kong.

However Mr. Trump’s tariffs might inflict injury on China’s economic system. “This time, it’s a lot deeper than simply market psychology,” Mr. Chen mentioned.

Christopher Buckley, Amy Chang Chien and River Akira Davis contributed reporting.