Residential Property Info & Market Insights:

iBuying: A solution variation strolling a limited rope

Opendoor and Offerpad successfully acknowledged a demand for home vendors– the capacity to line up the timelines in between advertising and marketing and getting a home. They use solutions to provide suppliers an instantaneous cash money offer. If it’s accepted, they fix the home and offer it on the free enterprise. The supplier can after that leave whenever their new home prepares to relocate right into.

This solution variation is very prime substantial, operates reduced margins, has long deal times and asks for high amount to get to breakeven. This is generally not a dish for success.

Most significantly, it relies upon a secure real estate market so homes can be exactly valued by the formula and turned for a sufficient margin. When the companies introduced, home costs were continuously increasing and sales amount was such that there was enough opportunity.

With an ingenious, tech-enable concept, the iBuyers transformed heads.

The marketplace leaps head at first right into iBuying …

As both organization obtained grip, gamers in the residential residential or commercial property market saw Opendoor and Offerpad as a danger, and iBuying as the possible method to winding up being the incredibly elusive “one-stop store” system for purchasers and suppliers.

Considerable gamers acted suitably, as Zillow, Redfin, Realogy (presently Anywhere and Keller Williams launched their really own variations of iBuying in between 2017 and 2019, and a range of innovation start-ups were developed with various rotates on the iBuying concept.

“I seem like I have no option currently,” Keller Williams chief executive officer Gary Keller stated in 2019 when his company joined the fight royal. “I can not allow Opendoor or Zillow to go out and be the only gamer in the iBuyer space and later on begin to identify terms and construct brand name around ‘they obtain houses.'”

… afterwards jumps right out

Provided the iBuying style relies upon threading a needle within a consistent market, it was evaluated after the pandemic begun in March 2020 The realty market changed unpredictable and produced a huge prices bubble, as property owner and buyers aimed to adapt to lockdown orders.

Zillow minimized its losses early by shuttering its Zillow Offers program in November 2021, as its formula quit working to adjust. A year later on, Redfin closed down Redfin Currently after it triggered a $ 22 million quarterly loss.

However Opendoor and Offerpad had no option nevertheless to maintain going. The pandemic bubble triggered significant spikes in revenue, with Opendoor tallying $ 5 15 billion in the first quarter of 2022, and Offerpad struck $ 1 37 billion, both all-time highs.

Nevertheless it really did not create long lasting desirable take-home pay, and in fact did instead the contrary. While both companies attained weak revenues in the really initial quarter of 2022, Opendoor experienced a substantial $ 928 million loss simply 2 quarters later on. In the fourth quarter of 2022, Offerpad uploaded its best loss at $ 121 million.

A shuffle to quit the blood loss

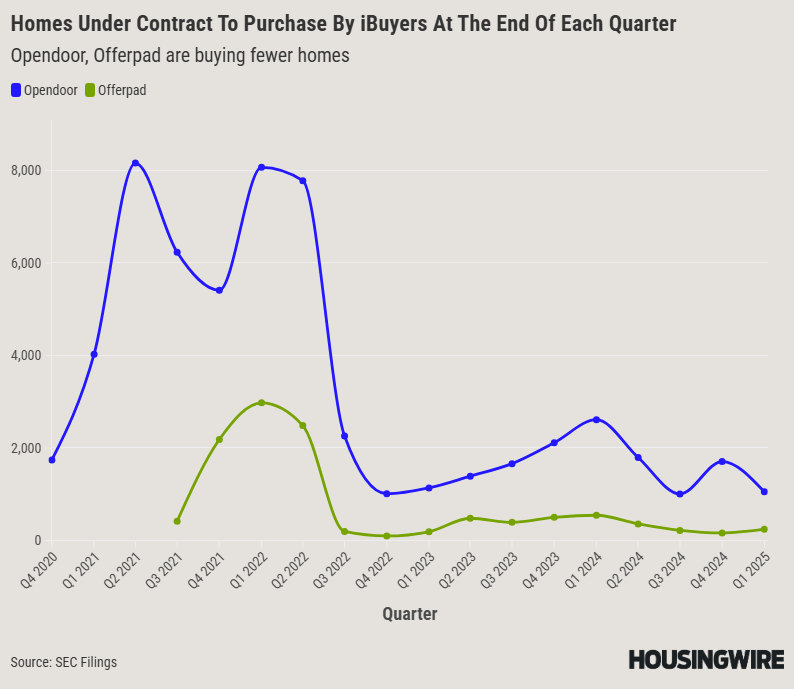

Opendoor and Offerpad have actually downsized their procedures significantly. In 2022, Opendoor bought just under 35, 000 homes. In 2024 it obtained 14, 684

The variety of homes they have under agreement to purchase completion of each quarter acts as a determining stick for buying job. At the end of the really initial quarter this year, Opendoor was under agreement for simply over 1, 000 homes, with Offerpad at 245 Those numbers are significantly less than the pandemic bubble top.

To counter the loss of earnings, both firms have actually aimed to boldy reduce expenses. Opendoor gave up 17 % of its labor force in November, which adhered to a 22 % decrease in April 2023 Offerpad gave up 7 % of its personnel in 2022 and an unidentified number to open 2023

Nevertheless according to Tomasello, there isn’t much meat on the bone turned over to lower.

While iBuying is a term acknowledged in the realty industry, it’s hardly recognized in all among the general public. In addition, Opendoor and Offerpad are not prominent brand either, so they rely on marketing and cooperations to create leads. This suggests they can simply decrease advertisement invest by a whole lot

Offerpad declares it’s retooling its marketing approaches to get a lot more out of the cash they invest, instead of investing even more cash.

“We’re being a whole lot a lot more purposeful with every marketing buck,” stated Offerpad Vice President Cortney Read in an email to HousingWire. “The objective isn’t to withdraw, nevertheless to designate invest where we’re seeing one of the most dependable return, whether that remains in digital networks, directly to customer, collaborations, or with our representative program.”

Where do iBuyers go from below?

Altering occupation strategy has actually harmed consumer view and home mortgage costs remain constantly high. The selection of homes sell has progressively boosted this year, nevertheless sales stay in accordance with in 2014’s historic lows.

With a whole lot macroeconomic changability keeping back a currently sagging realty market, where do iBuyers go from listed below?

Offerpad has in fact increased to various other remedies it specifies as “residential or commercial property light” in the hope of supplementing its iBuying procedure. These consist of listings remedies, home mortgage, title and a restoration company called Renovate, which created $ 5 3 million in Q 1 of this year.

Opendoor has actually formerly provided home mortgage borrowing and brokerage firm remedies yet has actually because shuttered those procedures as part of cost cutting in 2022

Both firms do not have much selection yet to be mindful and calculated worrying where and when to get homes. Doing or else could jeopardize the companies if the realty market transforms unstable once more.

Companies in this scenario could look for to market or combine with an additional organization, yet there’s no all-natural companion for such a bargain, particularly provided the significant gamers in property realty have actually currently cleansed their hands of iBuying.

Still, with their supplies teasing with the chance of being delisted, both firms can find worth in M&A if the very best scenario happens.

“In the routine program of company, like numerous firms, we opportunistically analyze calculated possibilities that our company believe would absolutely produce worth for our company and capitalists,” Read stated.

Review the complete article on the first resource

.